Thriving Profitable Practices 02 |

Getting Profit Fees Right

Author: Simon Berry, Founder of Fresh Projects

For years, I worked in a large AEC firm’s financial team. We had over twenty people running the accounting functions that supported the business. When reflecting on what actually made a difference, I believe there are really only three things to focus on:

- Win more of the right jobs

- Ensure project fees cover project costs

- Invoice early and collect debt quickly

This article will cover the second item.

Read about the other two here:

Here are the steps involved in determining the scope, budget and fee

Understand the problem you are solving for your client and the value you are providing them.

- Try and quantify (financially) the value-add to them. You can read more about this process here.

- Establish the scope of services to deliver that value. It helps to have a standard check-list of services for each project. A good starting point is the RIBA Standard Services which are included in the RIBA Contracts.

The steps involved in determining the scope, budget and fee

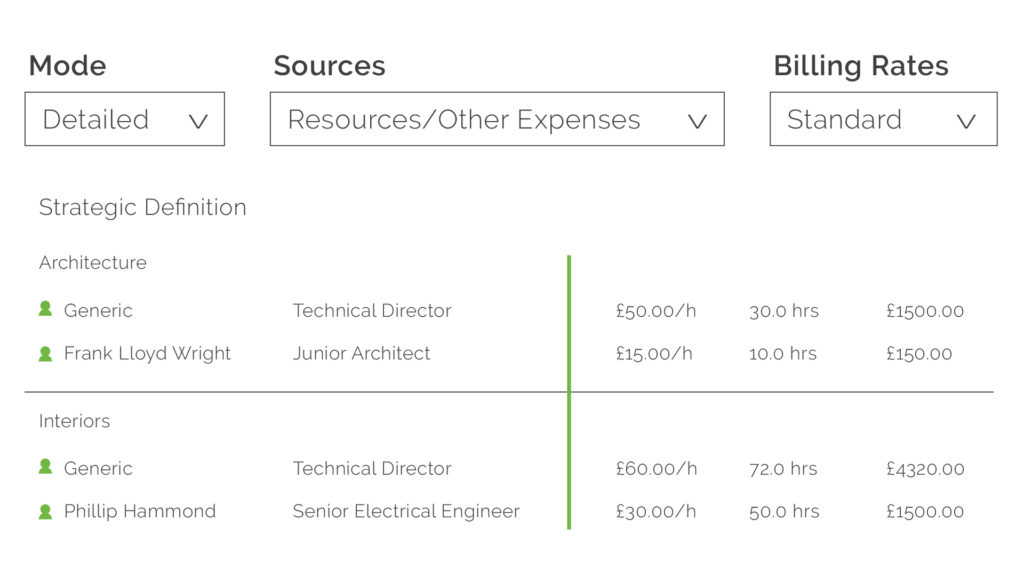

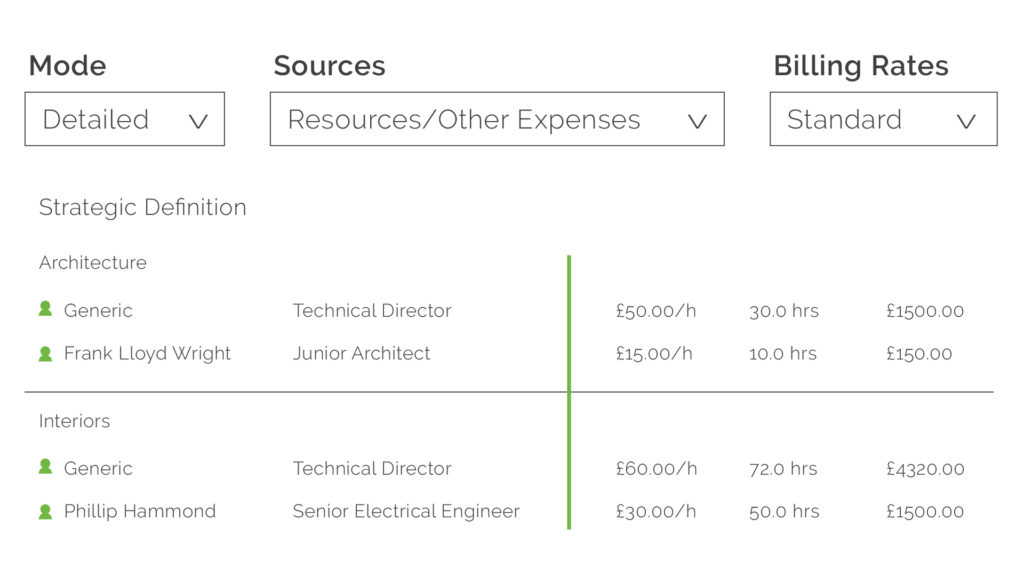

3. Estimate the cost to deliver the scope of services, including:

a. Labour costs: hours per person multiplied by their cost rate (include overheads and non-productive time).

b. Other costs: sub-consultants, prints & plots, travel, etc.

If the cost to deliver is more than the value-add, consider carefully if you wish to continue with the project – as these are often the problem projects (your client feels they are paying too much and you feel you are doing more than what you are getting paid for).

4. Calculate the fee which should, at the very least, cover your costs.

The steps involved in determining the scope, budget and fee

5. As a sanity check, compare the fee you have established to:

a. total project construction cost. The Fees Bureau publishes data on industry But be careful: just because everyone one else is charging 6% doesn’t mean it is the right fee.

b. previous similar projects (and check if you actually made a profit on those projects)

c. the value-add you are providing (from step 1)

6. If the client feels the fee is too high, establish what items in the scope of services can be excluded. Do not simply discount the fee and hope for the best.

Managing Scope Creep

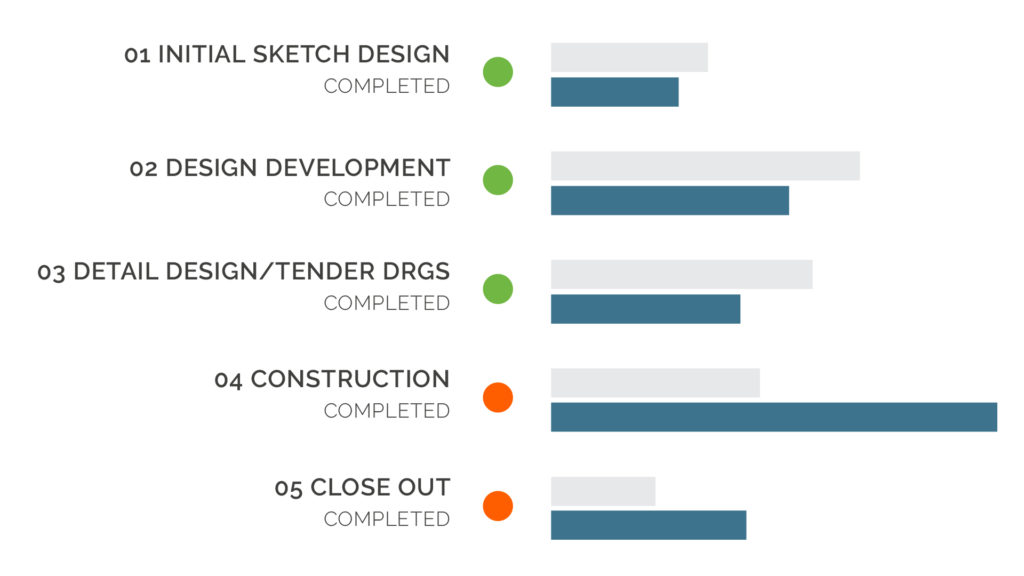

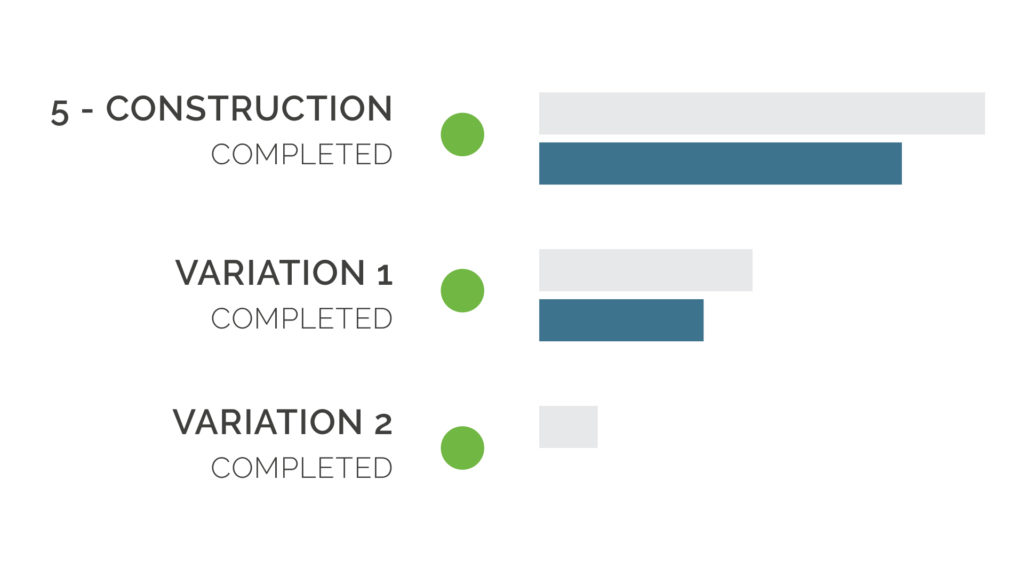

In our experience (our database has over 60 000 projects), most projects are profitable during the early design stages, but tend to fall apart during construction. The graph below is a typical example of how costs during construction/close out completely wipe out any profit that may have been earned earlier in the project.

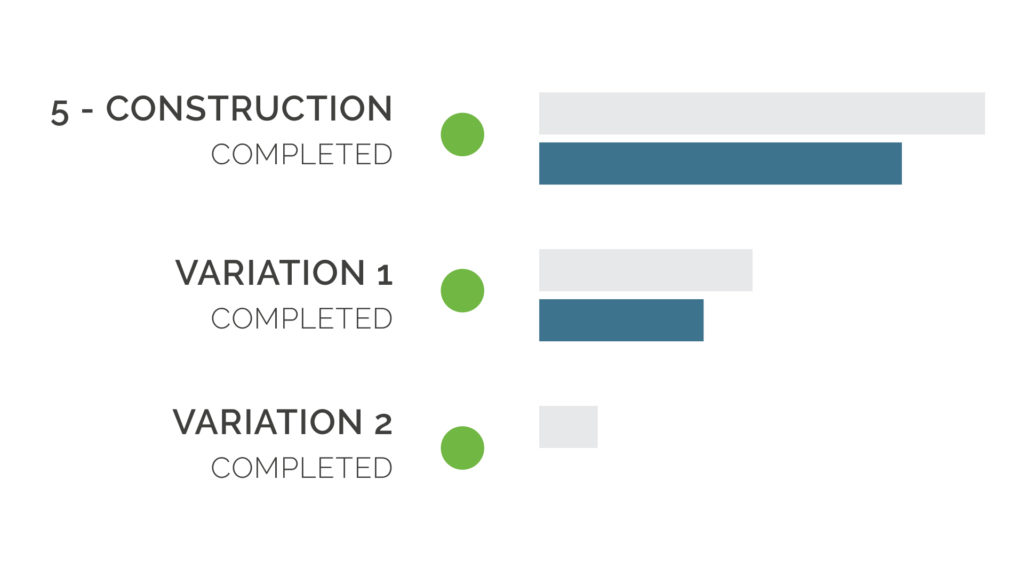

The main cause of cost overruns is usually scope changes or variations. Keeping track of these changes is vital. Tracking scope creep requires a significant cultural shift in our practice as the benefits of instilling an awareness of scope changes is hugely beneficial to profitability.

** The grey bars represent the fee and the blue bars the costs.

Managing scope

- Ensure staff are aware of the initial scope for each project. Share the scope of services document with your team.

- Teach all employees to identify if a request falls outside of scope. Ensure everyone understands the impact of scope creep (if the project doesn’t make money, the practice won’t make money).

- Track time and costs on additional work separately to time and cost on the standard services which allows for identification of scope creep sooner and gives an evidence-based approach to discuss additional fees with the client.

The original project stage will remain within budget, and maintain its profitability, while allowing for fees for the additional work that is undertaken to be recouped:

Managing Cash Flow

Hopefully we have demonstrated that to run a successful practice, it is critical that we don’t spend more on delivering our projects than what we charge our clients.

This is an obvious and fundamental issue that many architects ignore.

However, even if fees are calculated correctly and variations are tracked successfully, it is still very possible to go out of business if the client isn’t invoiced early and debt collected quickly. Find out more about the final step to running a profitable practice here. (Link to Article 03)